The phrase “printing money” tends to be tossed around in discussions about the money supply. How important is cash to the overall money supply?

Think about the structure of the FRB. How are they related to the Federal government? Recently they have injected a huge amount into the money supply. How did they do that?

And of course the all important question – what was the FRB’s most recent change to the money supply and why? What is your analysis of the current policies efficacy?

Printing Money is a simplistic view of what the Federal Reserve does to help control inflation. What is Money in 2020 anyway? It’s all digital numbers, a ledger that’s just as real as a bitcoin. The only real part of money is when you exchange it for a good, service, or cash so that you can hold it in your hands. When you look at your bank accounts on your iPhone bank app, it’s just numbers. The computers are keeping track of them closely, but I bet you aren’t balancing a checkbook any longer. How closely are you watching each transaction in that ledger? We leave it up to the software, which can be a little scary to think about. The Fed is doing the same thing. They aren’t printing money and dropping it off at banks from helicopters… they are pushing a key on a keyboard and moving numbers from 1 account to another. They might not even be pushing anything, the software could be making these calculations and ‘transfers’ based off of programed algorithms. Data in, if this then that, data out. Maybe we should stop using the term ‘printing money’ and start using the term ‘moving numbers’?

It seems that the Federal Government is too involved in the Federal Reserve. The Federal Reserve’s board of governors is made up of seven members appointed by the president and confirmed by the senate. Up until this election cycle, the president and senate were both controlled by the Republican party. Does this mean that the Federal Reserve is making decisions with the best interest of the entire country in mind? Or is it making decisions with the best interest of the Republican party, and Republican constituents? The check and balance here is the 14 year terms created to help insulate them from politics that have a short term horizon outlook on the world. They are allowed to retire of course, this could be influenced by politics.

Jay Powell – Republican – Term started in Feb 2012 (appointed by Barack Obama)

Richard Clarida – Republican – Term started in Sept 2018 (appointed by Donald Trump)

Randy Quarles – Republican – Term started in Oct 2017 (appointed by Donald Trump)

Lael Brainard – Democratic – Term started in June 2014 (appointed by Barack Obama)

Miki Bowman – Republican – Term started in Feb 2020 (appointed by Donald Trump)

$2.3 trillion injected into the US Economy in 2020 due to the Covid19 pandemic recession. How? Cutting the federal funds rate, keeping rates low, purchasing massive amounts of securities, lending to securities firms through the Primary Dealer Credit Facility program, backstopping money market mutual funds, etc etc etc. What an influence they have over our USA economy. Does the invisible hand even exist anymore with this much power at their finger tips?

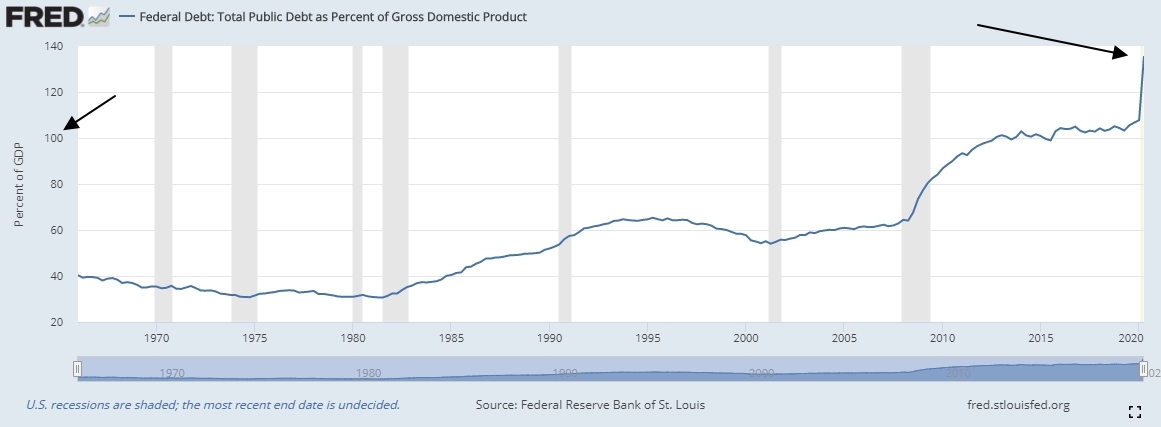

The most recent change is the increase in the money supply to help keep the economy from entering a long deep recession. The excess money pumped into the economy will keep credit flowing, and keep us consuming, and also help out businesses that are hurting from the loss of demand. I agree with taking drastic steps during a recession to help the economy recover quickly, but we must be diligent about keeping an eye on inflation as well as our debt to GDP as a nation. I fear that we have grown too used to uncle Sam bailing us out every time there is a recession. What about risks and consequences? Shouldn’t some companies and businesses, and even families, be allowed to ‘fail’ because they didn’t save for a rainy day? What about the people leveraged to their eye balls, while others are paying off debt wisely and living within their means? Have we created a culture where we have removed risk due to the backstop of the government and the unending supply of free cash that can be pumped into the economy at the first sign of a correction? It seems like we are inflating the numbers as we continually allow all American families to take on so much debt, and spend and consume without some risk and repercussions.

At what point does this entire house of cards fall down?