Capital makes more Capital. We all put money into banks. Whether it be our savings, checking, or retirement accounts. We have money put into banks. Banks turn around and use that money to give out loans for cars, homes, heloc, student loans, etc to other people.

Current bank rates for savings accounts are below 1% rate of return. My current savings account is a ‘high’ interest savings account at 0.49%. The opportunity cost of putting my money into this savings account is really costing me a fortune! Compare this savings account to the rate of return I’ve been getting on stocks this crazy roller coaster of a year 2020. I’ve been making on average about 50% on my stock investments. 0.50% for Savings, 50% for Stocks. It’s literally costing me some money. So why am I saving this money instead of investing it? Risk. Stocks can go down too. They can go down to zero. My savings account rate will never go below what I put in there, so never below a 0% rate of return. Even if the possibility of losing money in my investment accounts is small, it’s still a risk. There are ways you can minimize this risk with diversification, sure. But it’s still a risk.

I have been on the Dave Ramsey baby steps plan for many years now. I have always kept my 3-6 months of expenses of my “Fully Funded Emergency Fund” (baby step 3 on Dave Ramsey’s list) in a Savings account. I’ve kept my ‘investment’ money separate from this Savings account. This was a bucket of money I wanted to keep around for an “Emergency” so I wanted it to stay separate and free from my greedy little investment hands. What do you and your family consider to be an “Emergency”? I believe the intent of this bucket of money was to be there for unexpected doctors bills, dentist bills, vet bills, auto repair, loss of job or loss of rental income from your renter, or something like that. Definitely not to be used for a vacation or new mountain bike while you await your future paychecks to catch you up. So when we have one of these emergencies, how tough would it be to get my money into my hands when I need it? With the way we use our Credit Card and gain points each month, I don’t know if I’d need that money tomorrow. It would be more likely I would need that money in the next 30 days to pay back my credit card bill. Heaven forbid my wife or I would lose our jobs, when would we need the money by? Well I would assume by our next paycheck (that was now not going to arrive)… so 2 weeks? After giving this idea some thought, why wouldn’t I move money from Savings over to my greedy little investment hands? I bet I could sell those investments and get that money back within the timeframe I’ve discussed here 2-4 weeks. Risk, lets discuss….

In my investment portfolio I have a lot of great investment vehicles. For starters, my wife and I are ending our 30s and have had great careers. She’s been fortunate enough to have started her career with a degree. I was not able to get my degree and had to start my career without that piece of paper. I’m so glad to say that I’ve been successful without a degree in my career, but it took me a lot of extra work. Since both her and I have had a successful almost 20 years of working we have been given opportunities to invest pretax into 401ks and IRAs. The nice thing about these little nest eggs is they are limited to some mutual fund investment vehicles. These funds are in a way, already “diversified” to minimize market risk. So most of our wealth is in these accounts. I’ve personally loved getting to know the stock market the past 20 years and I’ve found my way into some great Index Funds and Individual Stocks. Individual Stocks are the most risky thing you can invest in. I’ve lost some money, but gained much more as I learned what to look for P/E or Price to Earnings, upcoming product innovations, market share, and market shifts have all helped guide my decision making with investments. Plus luck. You can never forget to mention LUCK.

What’s the Point? Risk.

How can we minimize risk in an investment account? How about buying Index Funds of different sectors you know should do well over the next year? Tech Stocks, Healthcare, Real Estate, Airlines, Autos, Space? Which industry do you think do well over the course of the next year? If they went down, how far down do you think they could go? How much money are you willing to lose if they go to that fictional bottom? How far up do you think they could go? Are you willing to risk the bottom, to potentially reach the top?

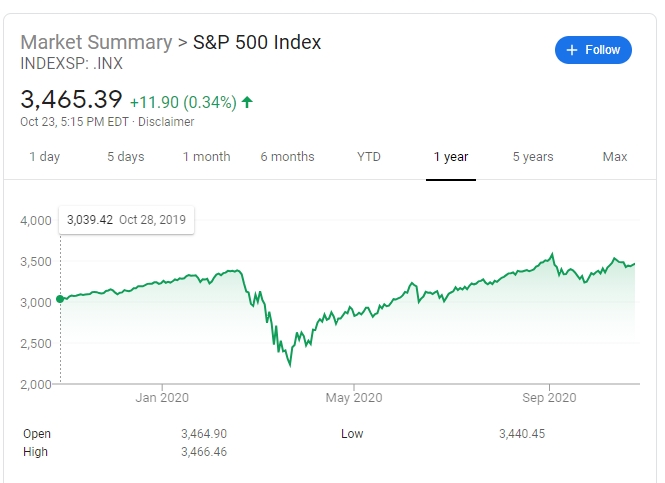

Lets take a nice round number of $10,000. If you left that in your “high” yield Savings account you would have $10,049 after 1 year (based on my savings account rate of 0.49%). $49 return. If you put that in the S&P 500 with the last 1 year average of about 12%, you would now have $11,200. Looks much better…. but what about April 2020? The S&P dipped down 27% from Jan to April due to the Coronavirus pandemic recession. Would you have stayed the course in April when the stock market dropped so fast? Would you have sold and pulled your money out? If I told you that your job was safe, would you have bought more stock back then? If I told you that your job would disappear next week, would you have sold and moved your money from investments and savings back to checking to help you get through this rough time? Risk.

Human Capital Investment

Right now I’m taking classes for 1 reason, to check a box. I’ve been working in technology since I was 16 years old. I dropped out of college at age 19 because I had 3 years of experience and after my first semester I got my bill and loan information and I realized that it wasn’t worth the money. The ROI didn’t look to be there with the high prices of upper education. I based that decision on my own experiences and went against what others had advised. They told me that it would be hard to go back later, and it would always hold me back, and one day….. one day I would hit a ceiling in my career. Without my degree, they told me, I would hit that ceiling. I think after 23 years in my industry I have hit that ceiling. I am currently a Director level manager leading a team each day to accomplish my company’s technology goals. I am good at my job. And I am compensated fairly. But I want more. I have never been someone who has given up on an idea or dream. I have never let anyone or anything hold me back from success. I am no stranger to hard work, and late nights studying. Since I dropped out of college I have made it a point to always try and be the smartest person in any room. It’s this drive for constant improvement that keeps me up at night as I research and learn, and research and learn, all the time consuming every bit of information I can. I do it for me. To make me better. I don’t want to ever hit that ceiling. I recently was looking for a change of scenery and I applied for a CIO position. CIO stands for Chief Information Officer. If you are working in the IT industry, CIO is the highest level you can achieve. This has been a dream of mine for many years now. I wasn’t allowed to interview for that other company’s CIO position because I couldn’t check a box. “Associates or Bachelors Degree” it said. I figured my 20+ years experience and resume of managing people, projects, budgets, and helping companies make strategic technology decisions would cover that check box. I was told it did not.

Is this that ceiling I was told I’d hit? It motivated me to complete my education. I know the road to complete this will not be easy. It will take time, money, but most of all, it will take passion. While I have a clear goal I set out to achieve in checking that box, I was surprised to find something else along my journey…. passion. I’ve always had a passion for learning, everyone knows this about me. But I had a different idea of what college was like. My idea of college was 20 years old, and based on a bad experience. I did not think college would spark such an interest in me, such a passion. I thought of college as outdated and disconnected from the real world and what actually goes on in the workforce. I’m glad to say I’m loving this experience the 2nd time around. I’m excited, not only for the future where I can check the box, but I’m actually excited about the process. That is the the day to day that I’m living right now. Learning new things, applying that knowledge, pressuring myself to achieve on a weekly basis.

After going through this process of returning to college for the 2nd time, I can honestly say that every dollar spent on education is worth it. Some dollars spent are more valuable than others, this is true. The timing has to be right for you. I’m 39 now, what do I want to be when I ‘grow up’? I am even thinking I need to set my sights higher than CIO now. I’m thinking business owner, partner, founder…. and of course Chief Innovator. To the future!

/cdn.vox-cdn.com/uploads/chorus_image/image/64074850/p186_71p_pub.pub16.1119_FINAL.0.jpg)