- What in this chapter made you think about an economic concept differently than your previous beliefs?

- What new questions do you have now about the US economy based on this chapter?

Chapter 1 breaks down economics in a simple way. There is a great sentence that sums up all of economics saying “Economics is the study of how society manages it’s scarce resources.” I bet we don’t typically think about resources in this way, as finite, scarce and limited. But it’s true that resources are all very scarce and limited. Land, Water, Air, Trees, Labor, Money, Gold, are not ever plentiful and abundant. It’s because they are scarce that they hold value and that value is determined based upon how abundant they are, and how easy it is to produce.

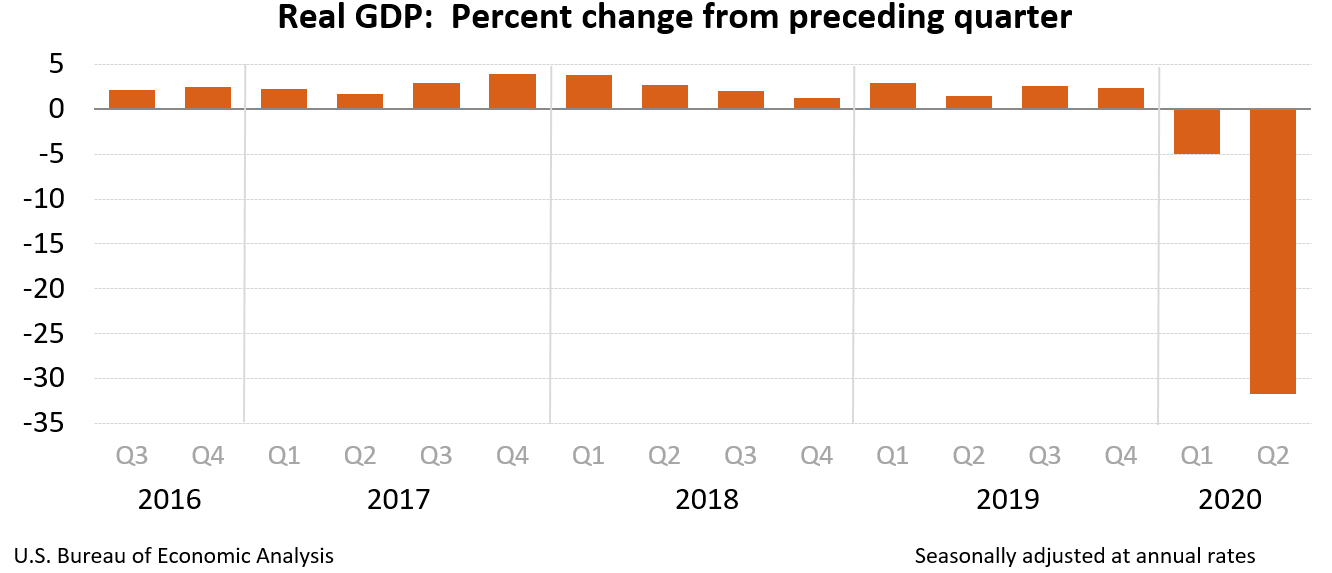

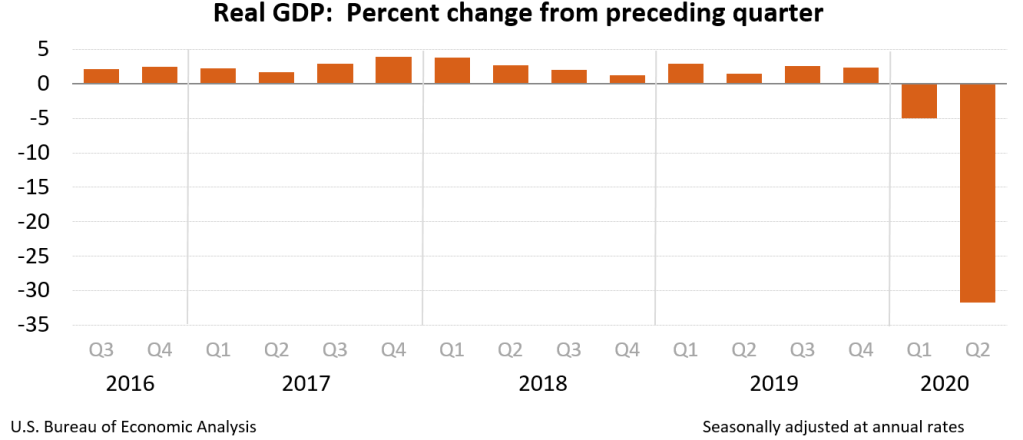

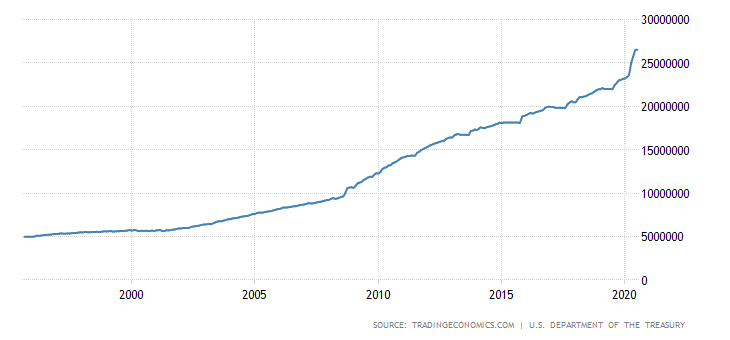

Economies face a trade off between inflation and unemployment, and this really hits us at this very moment as the US is in the middle of a recession due to the COVID 19 Coronavirus. Our country is printing money to help the economy survive and get through these tough times, with unemployment skyrocketing. But when will the inflation start? Will it be like Japan’s hyperinflation days? Were you aware that hyperinflation has also occurred in many other countries like China, Russia, Germany, and a few in South America too? Just today the CBO put out a statement saying that our US budget deficit will hit 3.3 Trillion this year. Compared to USA GDP that’s 16%. Either way when you look at our deficit it has to take it’s toll at some point, right? Additional guidance tells us that outlooks on the economy through 2030 show our deficit will reach only 5% of GDP. Does the deficit even matter if we can let it go up to 20% of our GDP? Is there a tipping point when hyperinflation sets in and takes over? Or is the US Economy so large and robust that it can run the risk of 15-20% (or more) of GDP? Some say “you have to spend money to make money”.

Maybe the lessons learned in the 2008 “Great Recession” allowed our economy to be stronger than ever by deleveraging and forcing banks to shore up their balance sheets? Perhaps that 2008 recession taught us all a lesson on risk and leverage? Or maybe, printing money and Quantitative Easing (QE) won’t cause inflation after all? After further research, it seems that hyperinflation isn’t caused by printing too much money (like the US has been doing for many years now), but rather from a full collapse of the underlying economy. What are some the risks to the underlying economy today? High unemployment? Demand falling due to coronavirus nervousness? Lets think about this together…

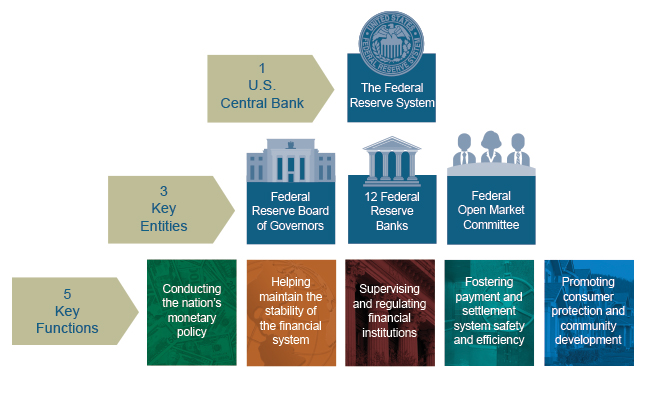

The Fed is the primary catalyst for inflation. Did you know that the Fed actually wants a little inflation? Inflation is a signal of a growing economy. Deflation is a threat we should be scared of just as much as too high inflation. Low inflation is actually the goal of the Fed. Inflation occurs when demand is greater than supply causing a rise in prices.

The Fed lowers interest rates = money is cheaper to borrow.

The Fed expands the money supply = money is more available, and cheaper to borrow.

The Fed reduces bank reserve requirements = more money to borrow.

Who is borrowing all this money?

Businesses need to borrow money for capital improvement projects, expansion, product development, etc.

People need to borrow money for home improvement projects, refinancing debt, buying a larger house, new car, boat, etc.

Get your popcorn ready, it’s going to be a great show.